property tax assistance program nj

Kiely said if your 2014 income was 100000 or less your rebate is your 2014 real estate tax multiplied by 15 percent with a maximum rebate of 1000. Homeowners negatively affected by.

Nj Property Tax Relief Program Updates Access Wealth

Property tax assistance program nj.

. Own and occupy an eligible one- to four- unit primary residence. In addition certain VITA Volunteer Income Tax Assistance aides have been trained to help older persons with their tax returns. You may not claim a reimbursement for a vacation.

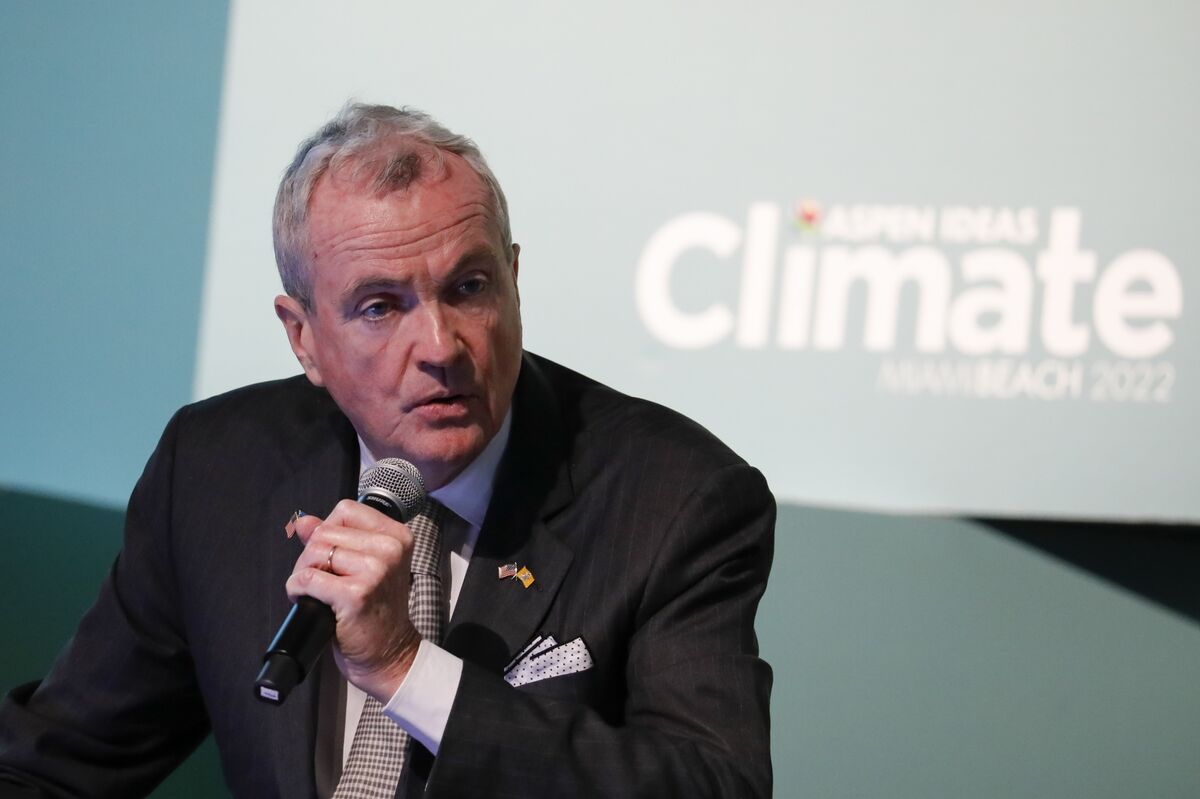

NJ Mortgage Property Tax Relief Program Coming Amid COVID Emergency Rescue Mortgage Assistance program will give up to 35000 to those who have. Some sites can provide service in one or two visits or you may not need to visit a site at all with all interactions taking place online. The Emergency Rescue Mortgage Assistance program ERMA will give up to.

Long-awaited help is coming for homeowners who have fallen behind on their mortgages property taxes and other expenses. NJ Division of Taxation - Local Property Tax Relief Programs. NJ Mortgage Property Tax Relief Program Coming Amid COVID Emergency Rescue Mortgage Assistance program will give up to 35000 to those who have been unable to pay housing bills due to COVID-19.

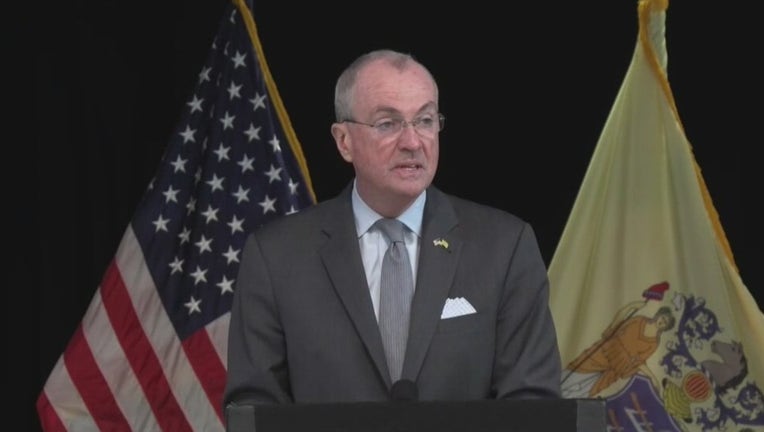

With 1500 and 1000 in direct property tax rebates for homeowners and 450 for renters more than 2 million New Jerseyans will see money back in. Under the new program New Jersey homeowners making up to 250000 would be eligible to receive an average 700 rebate in the first year and renters making up to 100000 would be eligible for a. Call NJPIES Call Center.

AARP Foundation Tax-Aide provides free tax preparation in different ways in-person low-contact or contact-free depending on what service is available in your area. Veteran property tax deduction Active military service property tax deferment 100 disabled veteran property tax exemption Property tax deduction for senior citizens and disabled persons. The program is open to homeowners who are older than 65 blind or disabled and earn less than 150000 annually or homeowners under age 65 who are not blind or disabled and earn 75000 or less.

Heating assistance rebates will be issued starting on october 18 2021. If your income was between 100000 and 150000 the credit is your property tax multiplied by 5 percent with a maximum rebate of 500. COVID-19 is still active.

All property tax relief program information provided here is based on current law and is subject to change. To qualify you must meet all the eligibility requirements for each year from the base year through the application year. The state has two programs that are supposed to help seniors with the costs.

New Jersey State Rebate Property Tax Reimbursement There are two separate and distinct property tax relief programs available to New Jersey homeowners. For most homeowners the benefit is distributed to your municipality in the form of a credit which reduces your property taxes. To receive the reimbursement an applicant must satisfy all eligibility requirements established by the State of New Jersey and file annually.

Nj Property Tax Relief Program Updates Access Wealth. If you are already approved for the Property Tax Assistance Program you will not need to apply again. You can also email the ERMA team at HAFServicingnjhmfagov or call us at 855 647-7700 between the hours of 8am and 5pm Monday through Friday.

Aside from tax relief programs you may be eligible for property tax exemptions in NJ. The Homestead Benefit program provides property tax relief to eligible homeowners. Complete the online application and provide documents.

You may use this form to apply for the Property Tax Assistance Program PTAP. New Jersey homeowners struggling to pay their mortgage or property taxes can apply for up to 35000 in aid when the state opens its application portal on Feb. Please bring your completed application form to your.

Senior Freeze Program Homestead Benefit Program Senior Freeze Property Tax Reimbursement Program Forms are sent out by the State in late Februaryearly March. Senior Freeze Property Tax Reimbursement The Senior Freeze Program reimburses eligible senior citizens and disabled persons for property tax or mobile home park site fee increases on their principal residence main home. For more information and to see if you qualify please see Property Tax Assistance Program.

NJ Mortgage Property Tax Relief Program Coming Amid COVID Emergency Rescue Mortgage Assistance program will give up to 35000 to those who have been unable. The Property Tax Reimbursement Program is designed to reimburse senior citizens age 65 and older and disabled persons for property tax increases. COVID-19 is still active.

New Jersey homeowners can apply for up to 35000 in mortgage and. Edison senior services provide a wide variety of services to senior residents of edison township. Sign and submit your application.

All property tax relief program information provided here is based on current law and is subject to change. Under the ANCHOR Property Tax Relief Program homeowners making up to 250000 per year are eligible to receive an average 700 rebate in FY2023 to offset property tax costs lowering the effective average property tax cost back to 2016 levels for many households that were previously ineligible for property tax relief. Through the Tax Counseling for the Elderly TCE program IRS-trained volunteers assist individuals age 60 and over with their tax returns at various neighborhood locations.

250 Senior Citizens and Disabled Persons Property Tax Deduction. NJ Mortgage Property Tax Relief Program Coming Amid COVID Emergency Rescue Mortgage Assistance program will give up to 35000 to those who have been unable to pay housing bills due to COVID-19. The Homestead Benefit program provides property tax relief to eligible homeowners.

There are four main tax exemptions we will get into in detail. Also renters making up to 100000 per. Access Wealth Plan For A Life Well LivedWealth Management Firm.

Stay up to date on vaccine information. September 2 2021.

Murphy Announces Details Of Property Tax Relief Program Whyy

Gov Murphy Unveils Anchor Property Tax Relief Program Whyy

N J Policy Expert Use Budget Surplus To Fund Equitable Common Sense Programs Opinion Nj Com

Nj Governor Leaders Agree On 2b In Property Tax Relief New Jersey News Us News

New Jersey S Current Rate Of 9 6 Percent Represents The Highest In The Area Well Above Those Of Neighboring States New Y Create Jobs New Jersey Working People

Nj Governor Unveils Anchor Property Tax Relief Program Morristown Nj News Tapinto

Schedule A Call With Maria Video Maria Testimonials Advertising

Murphy Proposes New Direct Property Tax Relief Program New Jersey Monitor

Real Estate Investing 101 Tax Lien Vs Tax Deed Investing Call Today 800 617 6251 Http Www Sportfoy Com Real Estate Inv Real Estate Nj Real Estate Real

Schedule A Call With Maria Video Maria Testimonials Advertising

New Jersey To More Than Double Property Tax Relief To 2 Billion Bloomberg

Nj Governor Phil Murphy Leaders Agree On 2b In Property Tax Relief

How To Apply For Section 8 In New Jersey Nj Hanfincal In 2022 New Jersey Jersey How To Apply

Home Energy Assistance Pennsauken Nj Energy Assistance Improve Energy Energy Efficient Homes

We Re Willing To Make A Deal To Restore N J Property Tax Break Top Biden Official Says Nj Com

Freehold Township Sample Tax Bill And Explanation

Back Tax Help Johnson City Tn 37601 M M Financial Blog Tax Help Back Taxes Help Irs Taxes

Tax Relief Bigger Rebates And More What Leaders Want To Do With N J S Extra Billions Nj Com

2021 Property Tax Relief Application Senior Freeze Now Available Borough News Borough Of Glen Rock New Jersey